Transport and Fleet

Building Your Construction Fleet:

A Practical Guide for UK Businesses

Construction Transport & Fleet Management Solutions

In the construction industry, having the right vehicles to suit your business is crucial for efficiency, reliability, and professionalism. Whether you’re a sole trader using a single van or a growing company expanding your fleet, making informed decisions about vehicle acquisition can significantly impact your operations and profitability.

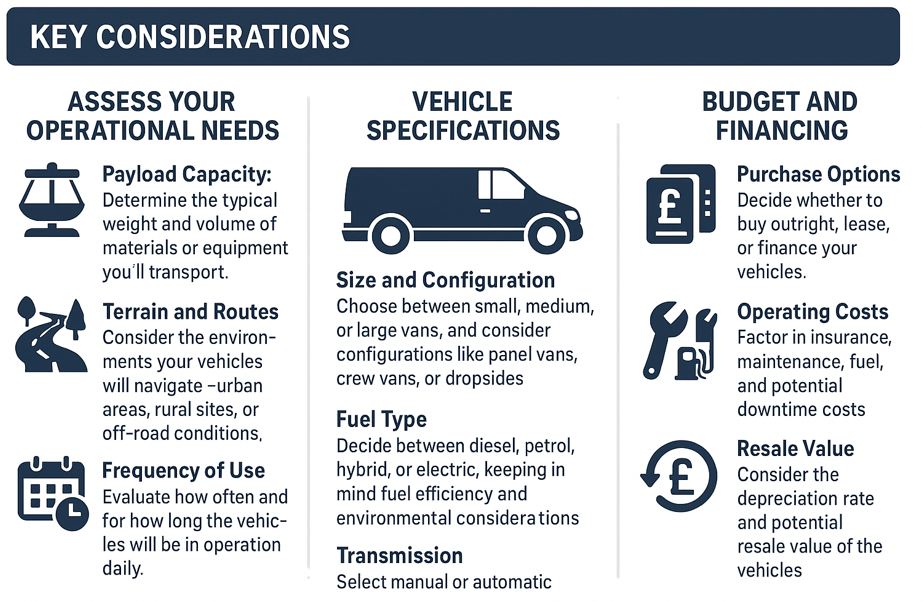

Key Considerations When Choosing Vans for Construction

Acquiring Your Fleet: Buying New or Used

New Vehicles

Benefits

– No history of misuse or accidents: A new vehicle should have no history of being in an accident or driven carelessly. This means that it should be mechanically sound and without hidden problems caused by previous owners.

– Wear and tear is minimal: Because the vehicle is new, parts have not had time and usage to wear out. Some vehicle parts will degrade over time even if the vehicle has been well looked-after.

– Full maintenance history: The maintenance history can be kept fully up to date, which adds to the potential re-sale value.

– Full warranty: If something should go wrong, a new vehicle will have a warranty under which repairs and parts are covered. It is worth checking the terms and conditions of the warranty, for example, what is covered, and how long it is in force for. Extended warranties can usually be purchased if you want extra peace of mind, but should be weighed up against the extra expense.

– Latest technological and safety innovations: A new vehicle will be up to date with the latest innovations, which might mean improved fuel efficiency, safety and performance and reduced emissions.

– Customization: Buyer can specify what features they want to include, rather than adapting their usage to a previous owner’s specifications.

– Re-sale value: Because it has the latest features and specifications, a new vehicle will retain more of its value than an older less advanced model. However, note that there will be a steep initial depreciation in value of around 20-30%.

– Tax benefits: Depending on your company status and the vehicle usage tax benefits or capital allowances may be available. You can claim the cost of the vehicle against your capital allowance, reducing your tax bill. Fuel, insurance and maintenance can also be offset against your profits.

There may also be financial incentives for buying an electric or low-emission vehicle. If you have a limited company you can Find out more about purchasing a vehicle for a limited company here.

Drawbacks

– High initial cost: Buying a new vehicle will use up funds that could be invested in other parts of the business. A high-cost vehicle might require financing or affect company cash flow.

– Higher insurance: High-value vehicles may cost more to insure than older, les-expensive ones.

– Depreciation: A new vehicle will lose a significant amount of its value instantly on purchase (perhaps 20-30% in the first year). However after this, a new vehicle will retain more of its value than an older one.

– Post-Warranty repairs: Because of its advanced technology and specifications a new vehicle may be more expensive to repair than an older one.

– ‘First-Year Model’ issues: There may be technological issues that the manufacturer hasn’t ironed out.

– Availability: New vehicles may take some time to be built and delivered.

Used Vehicles

Benefits

– Less expensive. A used vehicle will require less of a capital outlay than a new one, and the money saved can be put into other parts of the business, or additional fleet vehicles.

– Lower depreciation. A used vehicle has already been through the sharp initial purchase depreciation, so its value is more stable.

– Availability: Used vehicles will typically be immediately available, or have a short wait time.

– Lower Insurance premiums: As the value of the vehicle is lower, the insurance premium should also be lower.

– Proven reliability: A reliable used vehicle will have a full service history that proves it can be relied on. ‘First Year Model’ issues will not occur as the vehicle will have been in service already, and any of these teething troubles should have been rectified.

Drawbacks

– Wear and tear. Older vehicles will inevitably have older parts. Even if the vehicle has been used responsibly some parts will degrade and perish. This leads to more maintenance and expenditure on repairs and maintenance.

– Limited or no warranty: Used vehicles are often sold ‘as seen’ and without warranty. In the event of a breakdown or mechanical failure the burden of repair costs will fall on the owner.

– Outdated technology: Older models will lack the latest technological innovations in safety, performance and emissions.

– Hidden problems due to lack of care or damage that has been covered up. It’s very important to check the service history. You can check the MOT history to look for structural damage that has been repaired. You can also use these services to check if a vehicle has been stolen, written off by an insurer or has outstanding finance on it. AA Vehicle Check – Carwow – HPI Check.

Rather than buying outright, you might consider leasing a vehicle. You should consult your accountant before entering into a lease contract.

Leasing Vehicles

Rather than buying outright, you might consider leasing a vehicle. You should consult your accountant before entering into a lease contract.

Benefits

– Upfront expenditure: Leasing can reduce upfront costs and spread the expense over an agreed term. Reducing the upfront cost frees up funds for investment into the business.

– Fixed payments: The expense is fixed and predictable, which helps with budgeting.

– Access to new vehicles: You will have access to the most up-to-date vehicles, which will come with the latest technical innovations for safety, performance and emissions.

– Maintenance: Many lease agreements come with maintenance and repair plans, which help to keep your business on the road and reduce potential downtime.

– Flexibility: If your business needs change, you can change your lease to suit them, for example adding to the fleet, or reducing it. This means that you can always have the right number of vehicles for your work.

– Tax: Monthly lease payments are tax-deductible, so they reduce a company’s tax burden. If your company is VAT-registered you may be able to claim some of that back. Find out more here.

Drawbacks

– Ownership: Depending on the type of lease, at the end of the contract the vehicle may be returned to the leasing company, and will not be an asset of the business. Different types of lease are detailed below.

– Mileage: Lease contracts generally include mileage limits, and if these are overrun charges may apply.

– Wear and tear: Vehicles need to be returned in a suitable condition. This is specified by the BVRLA guidelines. There may be financial penalties for non-compliance. Find out more here.

– Ending the contract early: There are generally hefty financial penalties for withdrawing from a lease contract early. Make sure you understand the implications of taking out a lease before you sign the contract.

Types of Lease

– Operating Lease: Renting the vehicle for a set period without ownership at the end. The leasing company is responsible for maintenance. Usually there is no option to purchase the vehicle at the end of the contract. The rental payments are treated as operating expenses for tax purposes, and so reduce the construction company’s balance sheet. The company can upgrade to new models. Monthly payments tend to be lower than for the other types of lease agreement.

– Finance Lease: Suitable for companies that want to use a vehicle without buying it outright, thus avoiding a large upfront cost. The finance is secured against the vehicle, so if you’re unable to pay the monthly instalment it can be repossessed. There are various options at the end of the lease term. These are:

– Continue to lease the vehicle (‘secondary rental period’).

– Sell the vehicle and keep a share of what it is sold for.

– Return the vehicle. Perhaps it is no longer suitable or you wish to upgrade.

– Hire purchase. A deposit is paid and monthly instalments are paid vehicle over a fixed term. At the end of the term, the vehicle is transferred for a small fee. These agreements are usually made by small companies that wish to own the vehicle but avoid a large up front fee. VAT-registered companies may pay VAT up front.

Fuel Card, Tracking and C02 Emissions

Managing fleet and targets

Enhancing Efficiency with Fleet Management

Implementing fleet management systems can provide:

Real-Time Tracking: Monitor vehicle locations to optimise routes and reduce fuel consumption.

Maintenance Alerts: Receive notifications for scheduled servicing to prevent breakdowns.

Driver Behaviour Monitoring: Assess driving patterns to promote safety and reduce wear and tear.

Fleet Management Services

Fleet management companies offer services such as maintenance scheduling, telematics, and compliance management to streamline operations and help achieve Health and Safety compliance.

Benefits:

– Ownership: Depending on the type of lease, at the end of the contract the vehicle may be returned to the leasing company, and will not be an asset of the business. Different types of lease are detailed below.

– Mileage: Lease contracts generally include mileage limits, and if these are overrun charges may apply.

– Wear and tear: Vehicles need to be returned in a suitable condition. This is specified by the BVRLA guidelines. There may be financial penalties for non-compliance. Find out more here.

– Ending the contract early: There are generally hefty financial penalties for withdrawing from a lease contract early. Make sure you understand the implications of taking out a lease before you sign the contract.

Benefits of Fuel Cards

Cost Savings

Fuel cards often provide discounts on fuel purchases. For instance, some cards offer savings of up to 10p per litre compared to the national average. Although there are some drawbacks to using fuel cards the benefits generally outweigh them. You should choose carefully. Since there are many cards to choose from, it you may benefit from searching on a comparison website. Here are some links: https://comparefuelcards.co.uk/ | https://www.icompario.com | https://yournrg.co.uk | A to B

Simplified Administration

Fuel cards consolidate fuel expenses into single, HMRC-compliant invoices, which eliminate the need for paper receipts. They also simplify VAT re-claims. They integrate seamlessly with accounting systems, reducing administrative burdens. Fuel cards can help with budgeting and cost controls by setting spending limits and monitoring spending in real time. The access to clear data makes budgeting and forecasting fuel costs easier.

Enhanced Control and Security

Managers can set spending limits, restrict fuel types, and monitor transactions in real-time, reducing unauthorised purchases and fraud

Comprehensive Reporting

Detailed reports provide insights into fuel usage by driver, vehicle, or job site, aiding in budgeting and identifying inefficiencies, for example in identifying efficient routes.

Wide Acceptance

Many fuel cards are accepted at a comprehensive network of stations across the UK, including major brands and supermarkets, ensuring convenience for drivers. However, some cards are more specific about where they can be used.

Drawbacks of Fuel Cards

Fees and charges

Many fuel cards come with monthly or annual fees and service charges. These need to be factored in to cost savings calculations.

Limited acceptance

If a card is limited to a certain fuel provider or filling station it can add considerably to the driver’s route, especially in rural areas.

Fraud and misuse

There is potential for drivers to misuse the card or for stolen cards to be used. However, most will have measures to mitigate this risk.

Terms and conditions

Make sure that the card’s T&Cs aren’t overly complex and make the card difficult to use.

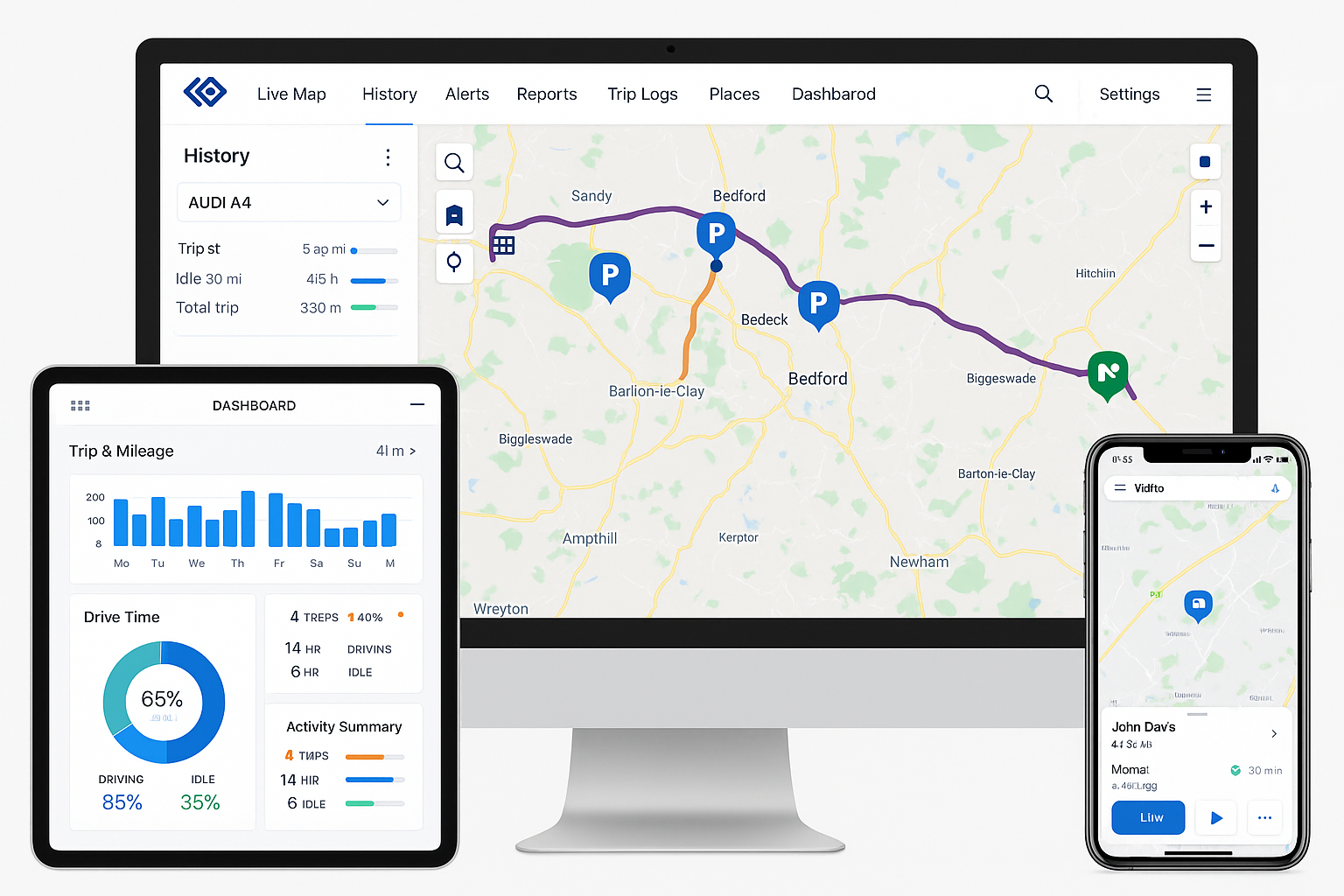

Vehicle Tracking & CO₂ Emission Tracking

Why Vehicle Tracking Matters

In construction, managing a dispersed fleet across multiple job sites can be challenging. GPS vehicle tracking systems provide:

Real-Time Location Monitoring

Keep track of your fleet’s exact location at all times—helping reduce downtime and route inefficiencies.

Improved Fleet Productivity

By monitoring idle times, detours, and job durations, you can optimize deployment and reduce wasted hours.

Theft Prevention & Asset Recovery

Construction vehicles and machinery are valuable assets—real-time tracking helps ensure fast response in case of theft.

Driver Behaviour Monitoring

Monitor speed, harsh braking, and acceleration patterns to promote safer, more fuel-efficient driving.

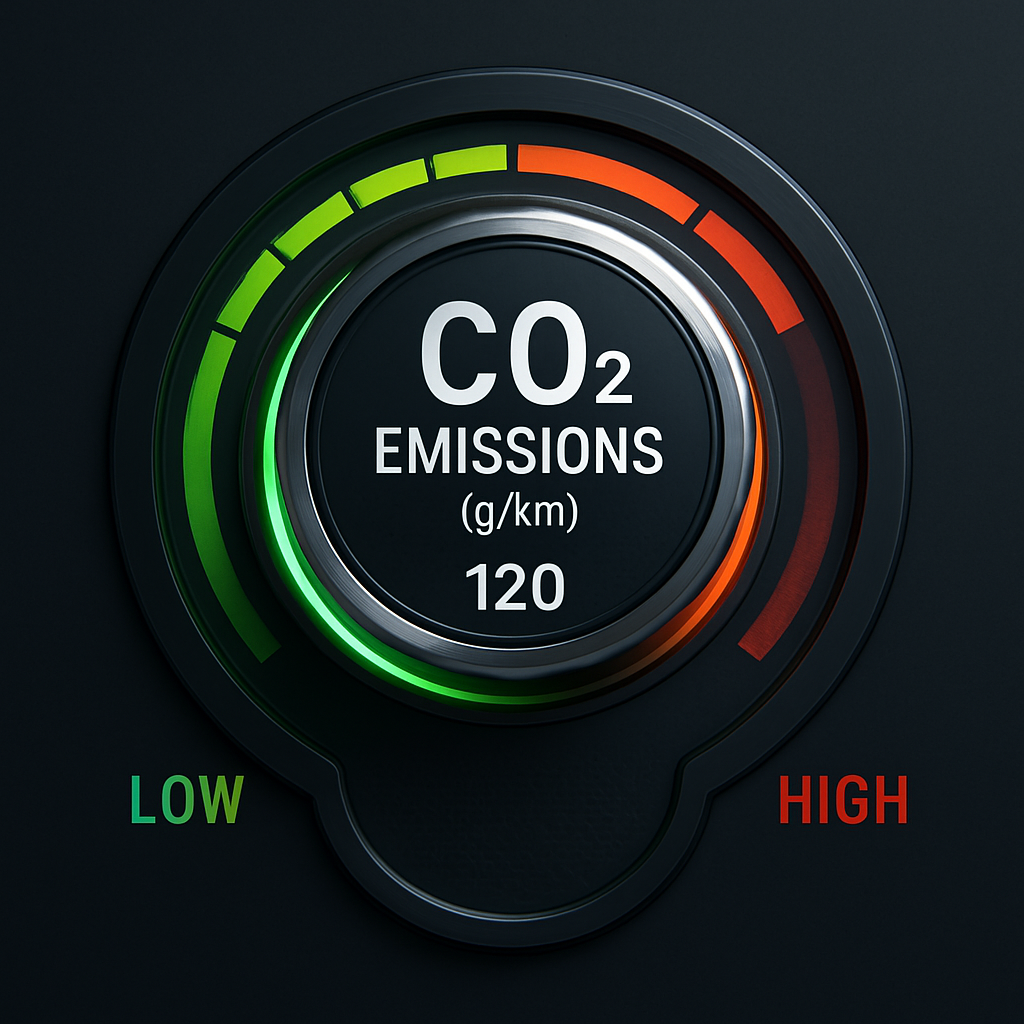

CO₂ Emission Tracking for Sustainability Compliance

The UK and European construction industries are under increasing pressure to meet sustainability targets. Although CO₂ emission tracking is not yet fully mandatory across the construction industry, the UK’s Streamlined Energy and Carbon Reporting (SECR) and European Corporate Sustainability Reporting Directive (CSRD) are already mandating some large companies to report greenhouse gas emissions. A new tool has been developed by the UK Government to help assess road user’s carbon emissions. This is called the Vehicle Emission Carbon Tool (VECAT). You can find it here.

Carbon accounting software can help keep track of emissions. Here are some of the most popular products (the list is not exhaustive or in order of preference): Plan A | IBM Environmental Intelligence Suite |Sinai Technologies |IBM Envizi |Klimahelden Microsoft Sustainability Cloud | Salesforce Net Zero Cloud | Sphera | Cority | Workiva | Sami | Emitwise

Automated Emissions Reporting

Tools integrated with fuel usage data and telematics can automatically calculate and report carbon emissions for regulatory compliance. The software tracks, monitors and reports on fleet emissions and offers data-driven insights for reducing them, for example by changing driver habits, or through electrification. Automation saves time and resources, helps to ensure compliance, supports sustainability and provides useful data. There are a variety of tools available online (the list is not exhaustive or in order of preference): Smartrak | Sawatch | Alphabet | Lightfoot

Carbon Footprint Dashboards

Many systems offer visual dashboards showing emissions by vehicle, job site, or driver. This helps businesses identify areas for improvement. Here are a few companies (the list is not exhaustive or in order of preference) Normative | MRI Software | Microsoft | Carbon Neutral Group

Compliance with UK Regulations

Stay ahead of UK legislation such as SECR (Streamlined Energy and Carbon Reporting) and prepare for future carbon reporting requirements.

Customer Confidence & Bidding Advantages

Demonstrating your sustainability credentials can help win tenders, especially with public sector or eco-conscious clients. A clear sustainability strategy builds trust and client confidence.

Conclusion

Selecting the right vans or fleet for your construction business is a major strategic decision that affects daily operations and long-term success. By carefully assessing your needs, exploring financing options, and considering fleet management solutions, you can build a reliable and efficient fleet that supports your business goals and demonstrates your commitment to sustainability and good practices.

For more insights and assistance on building your construction fleet, visit www.specifyhub.co.uk.

Always consult with vehicle and financial advisors to ensure your choices align with your specific business requirements and comply with UK regulations.